COVID-19 and Financial Wellness What happens if household incomes don't return to normal soon?

The province of Québec is leading Canada in terms of reopening its economy¹. What are some financial risks if household incomes in Québec don’t return to normal soon? Are there parallels to be drawn to the rest of Canada? Which areas are most impacted financially and what does this mean for Québec’s real estate market?

We can create a simple potential mortgage default index in Polaris by multiplying the following variables²:

- % Household income from employment

- Average mortgage on principal residences

- Total population employed in industries that were critically hit by COVID-19 (the retail, real estate, accommodations, and food industry)

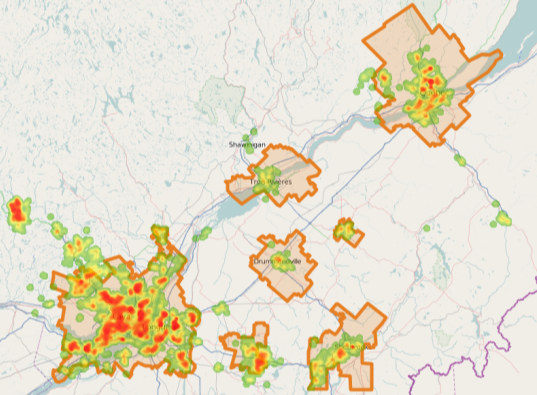

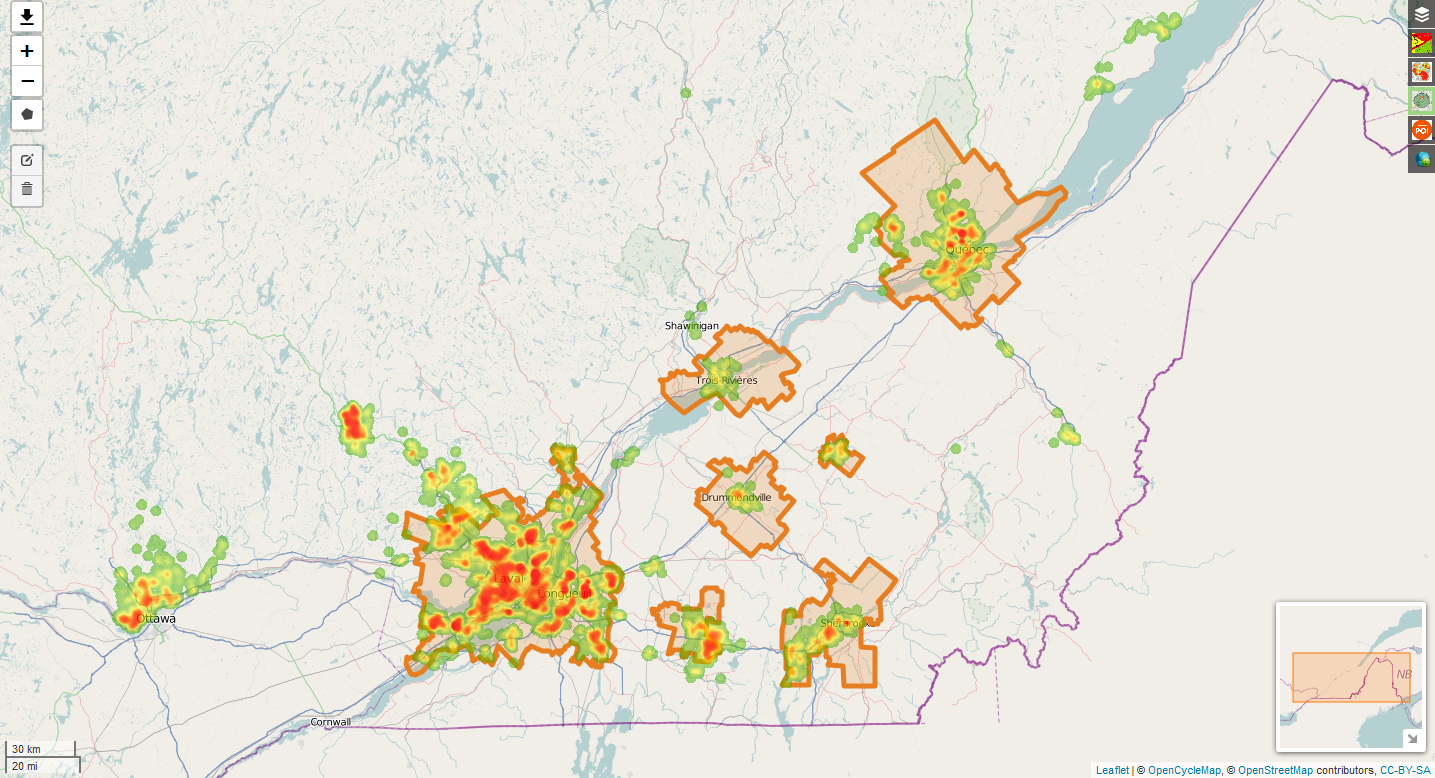

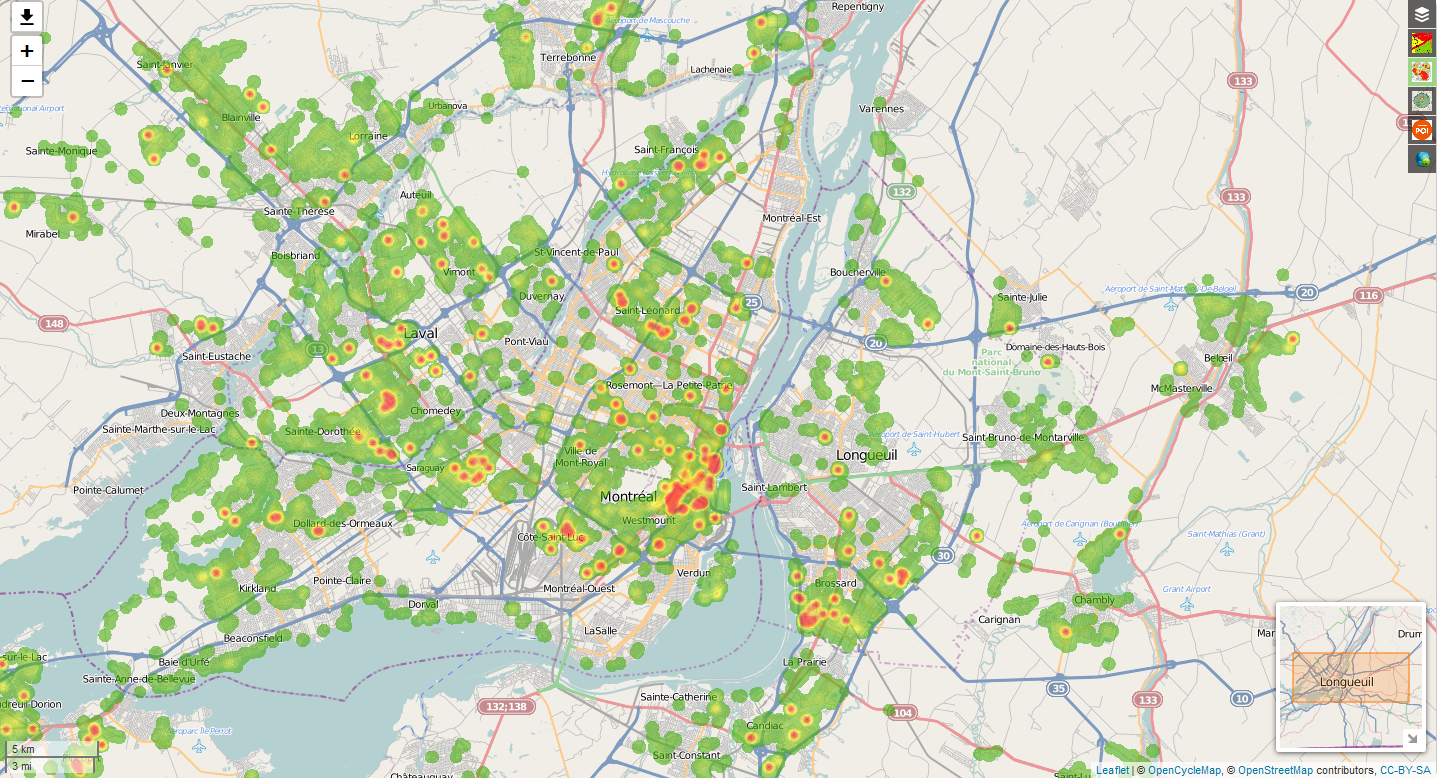

We use a heat map to visualize the total dwellings with a high risk index in a few CMAs and CDs in Québec. Montréal and Québec City CMAs for example, have a large number of dwellings with high indices indicating their susceptibility to defaulting on mortgages.

Within Montréal CMA, the high indices are driven by neighborhoods surrounding Laval, specifically Saint Dorothée and Chomedey. Neighbourhoods at high financial risk can also be found around Downtown Montréal, and are especially concentrated in Centre-Ville. Most of Longeuil is not at high-risk.

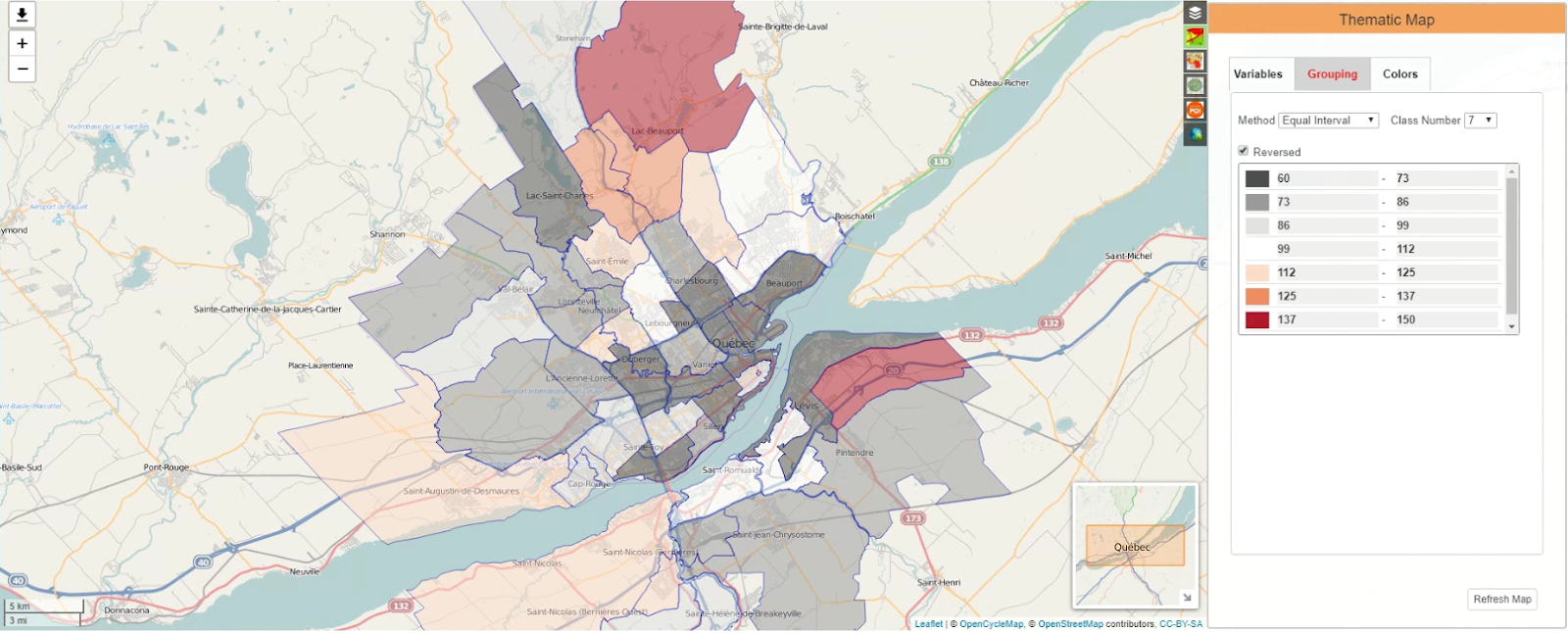

Within the Québec City CMA, the most at risk neighbourhoods are Lac-Beauport and just east of Levis.

If household incomes don’t return to normal soon, some families could have a hard time paying their mortgages. This makes mortgage deferrals all the more important. Additionally, while this blog post zooms in on Montréal and Québec City, there are neighbourhoods like these all across Canada. COVID-19’s financial impact is significant and it affects Canadians from coast to coast.

It is worth noting that this analysis also captures the areas with large mortgages (by absolute value). For example, if many real estate developers live in a neighbourhood, and they all have expensive homes that are leveraged (e.g. multi-million dollar homes that are 30% mortgaged), that neighbourhood will be flagged.

Stay tuned for part 2 of this blog post which will zoom in on areas where households spend 30% to 100% of their income on shelter.

References