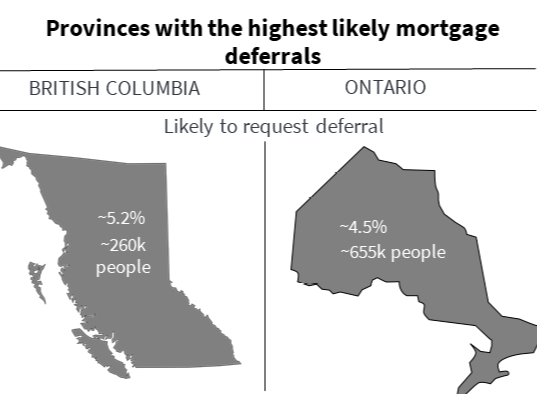

More than 1.5 million Canadians (4% of the Canadian population) will likely ask for a second mortgage deferral in October 2020, and here’s why. Despite partial reopenings, spending on critical sectors is still down. Pre-COVID, 22% of Canadians were employed in these suffering sectors: retail trade (~11% of Canadians), accommodation and food services (~7%), arts (~2%), and real estate (~2%) industries! For RBC in Ontario and BC, that’s $8.5 billion of mortgages at risk! […]

Second Wave of Mortgage Deferrals Coming