Second Wave of Mortgage Deferrals due to COVID-19 Coming

Introduction

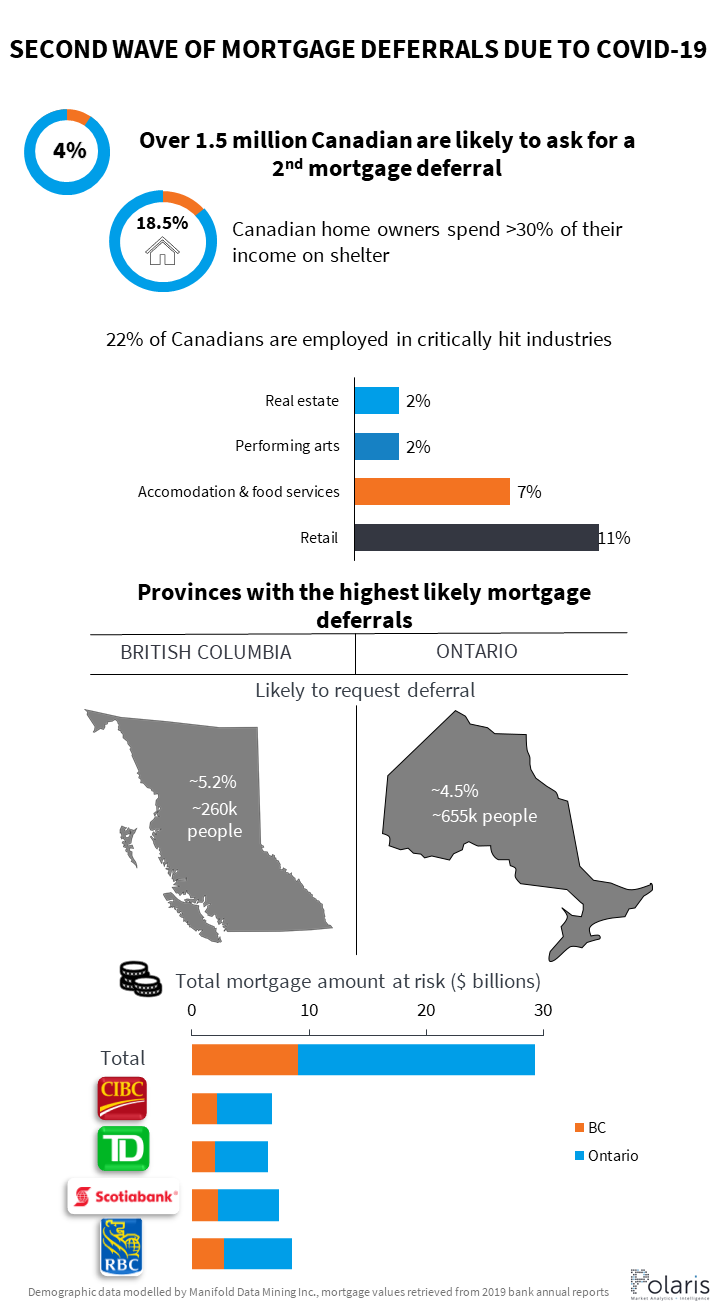

More than 1.5 million Canadians (4% of the Canadian population) will likely ask for a second mortgage deferral, and here’s why. Despite partial reopenings, spending on retail, accommodation and food services is still down, with large chains, such as DavidsTea, filing for bankruptcy every week. 22% of Canadians were employed in these suffering sectors: retail trade (~11% of Canadians), accommodation and food services (~7% of Canadians), arts (~2% of Canadians), and real estate (~2% of Canadians) industries! Many of these Canadians who own their own home also spend >30% of their income on shelter costs.

Where can we find the population that is employed in these critically hit industries and spend a great portion of their income on their owned households? BC and Ontario are hotspots for individuals that meet these criteria. If we make simplifying assumptions and assume that households spending more than 30% of their pre-COVID income are equally distributed amongst all Canadians rather than concentrated in these heavy-hit industries, we can estimate that ~5.2% (261, 129 people) of BC and ~4.5% (655, 139 people) of Ontario are made of individuals who are employed in the abovementioned critically hit industries and are household owning houses while spending more than 30% of their pre-COVID income on shelter-related expenses.

Which banks will be hardest hit?

Which banks should prepare themselves for this large wave of second mortgage deferrals that is to come their way? RBC has the largest value of residential mortgages in Canada, and is the most exposed. In Ontario and BC, that’s $8.5 billion of mortgages at risk for RBC! Scotia has $7.4 billion at risk, followed by CIBC at $6.8 billion and TD at $6.5 billion.

Questions?

If you are interested in finding out how Polaris can help you prepare for the economic impact of COVID, understand your market better or simply ask a question, contact us for a demo or consultation.